Debt Market Update | April 2025

April 22, 2025

Market Uncertainty – “Should We Stay or Should We Go?”

Recent market fluctuations cannot be ignored when reviewing the current debt markets. Outlooks published as recently as early 2025 bare limited relevance to current observations. Both the Merrill Lynch Option Volatility Estimate (MOVE) and the CBOE Volatility Index (VIX) have risen dramatically since the start of the year (37% and 72%, respectively). Although the duration of this trend is uncertain, these conditions have led to tightened credit environments, particularly affecting M&A and the overall market outlook.

Volatility presents a challenging environment for middle market companies, particularly those in manufacturing and consumer products seeking capital

As Morningstar/DBRS predicted in February, tariffs on imported goods will increase the cost of raw materials and components to the end-user, posing challenges for lower-rated companies, especially those in sectors like manufacturing and consumer products. While some companies may more easily pass on higher input costs to their customers, others face meaningful constraints against doing so. Many of these companies may be forced to absorb the increased costs. This could lead to deteriorating operating cash flows, weakened credit metrics, and a cash-constrained balance sheet.

Meanwhile, commercial banks, traditional lenders have retreated

Banks, traditionally the backbone of middle market loan issuance, have taken a back seat in recent years as they face pressure from regulations, investment challenges, and economic uncertainty.

Nonetheless, debt financing remains available

Despite these challenges, debt financing remains available to middle market borrowers, offering much needed flexibility to a company’s capital structure. Thanks to the substantial amount of private debt capital raised in recent years ($1.2T since 2020), access to debt financing is still feasible.

Enter the growing reliance on specialty finance

Specialty finance and alternative credit solutions play a pivotal role in filling the gap left by traditional banks, offering flexible and bespoke financing options, both asset-based and cash flow driven, to middle market borrowers and private equity firms:

- Asset-Based Lines: Higher advance rates on receivables, inventory (even international), and equipment

- Bridge Loans: Quick cash to smooth timing hiccups

- Senior Cash Flow: First lien cash flow facilities at or near traditional bank financing rates

- Mezzanine Financing: Subordinated debt with equity upside, keeping ownership intact

- Unitranche: Senior and junior tiers of debt blended into a single offering

- Non-Traditional Collateral: Tapping IP or royalties for offbeat deals

Bringing timely benefits to the middle market borrower

Specialty lenders bring speed (30–60 day closings), flexibility (such as PIK toggles), and value-add expertise at relatively competitive pricing.

Benefits of specialty credit

In a calmer, but still choppy market, Debtwire/SRS Acquiom’s recent survey found that speed of decision-making (69%) is the top quality that companies value about private credit.

But sourcing the right lender to produce the best term sheet can be challenging and time-consuming

A recent Proskauer survey of 152 private lenders revealed that less than half (27%) of private lenders close more than five out of every one hundred deals they review. For middle market companies and their sponsors focused on day-to-day operations, the time involved in sourcing the right lender with the optimal terms can be a substantial distraction.

Indicative Market Terms

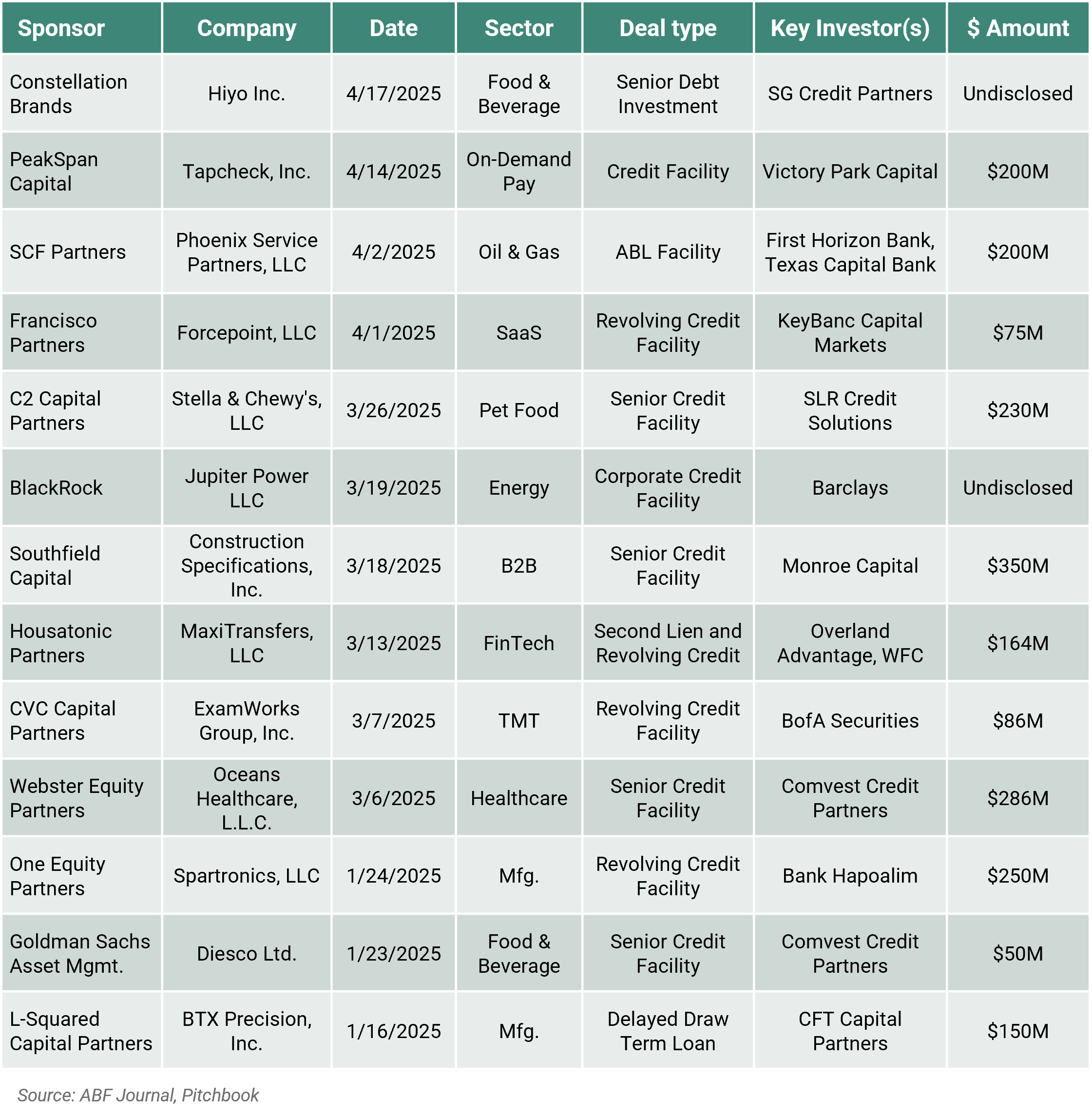

Recent Sponsor-Backed Market Transactions

How Ankura Capital Advisors Can Help

The professionals at Ankura Capital Advisors know the market and know the lenders. We work closely with both sponsor-backed, and non-sponsor backed companies, assisting them in sourcing the most competitive financing terms from the lenders best suited to help companies recapitalize and/or grow their business.

Learn more, download the PDF version of this article >>

For more information, please reach out to project leads Kathleen Lauster, CFA, and Matthew Lapish, and Jeffrey Goodman.

© Copyright 2025. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.